Tuition and Financial Aid FAQ

Vanderbilt Student Account Set Up

What is my Vanderbilt User Account?

Your user account is your VUNetID. This will allow access to student services, your VU email, and your YES (Your Enrollment Services) portal.

How do I set up my VUNetID and Password?

The University Registrar will begin the process by sending a message to your personal email account within two weeks following payment of your matriculation fee. The subject line of the email is “Invitation to Vanderbilt University”. Check your Spam or Junk email folder for missing emails from Vanderbilt University. Your VUNetID and Access Code should pre-populate. You may start the claim process by visiting the VU Information Technology page.

How do I set up my Vanderbilt email address?

Your Vanderbilt email address is the official address for communications from the Dean’s Office, the Department Chair, the Program Director, all course professors, Office of Student Account, Office of Student Financial Aid, and our Student Success team. You can forward your mail from this address to any email address you wish to use.

After you officially enroll at Vanderbilt University, you will receive an email to create your VUNetID. To begin the account claim process, click on the link in your “Invitation to Vanderbilt” email.

What is YES?

Your Enrollment Services — YES — account includes access to academic records, billing, financial aid, direct deposit set up, and more. You will need your VUNetID and Password to log into YES — yes.vanderbilt.edu.

Tuition and Billing

What is the cost of the Vanderbilt Peabody online programs?

Tuition is based on the number of credits for which you register. Current tuition rates are $2,405 per credit. Additional information about each program can be found at the program website.

Are there additional fees?

A health insurance fee is charged each semester. Review the full schedule of tuition and fees for Vanderbilt students.

Can any fees be waived for online students?

You may request the health insurance fee to be waived by contacting Student Health Insurance Plan (SHIP).

How much is the enrollment deposit?

There is a $250 non-refundable enrollment deposit.

Can I use financial aid to cover the deposit?

No, federal student aid cannot be used to pay the deposit.

When will I receive a tuition bill and when is payment due?

Vanderbilt Office of Student Accounts sends e-bill notifications the first of each month.

How do I view my bill?

E-bills will be emailed to your Vanderbilt email address. You may access your online invoices from your YES landing page. Once a student has signed in to YES, invoices may be viewed under the Billing Portal link.

What are the accepted forms of payment?

There are multiple payment methods available.

How does my employer go about paying the school?

Third-party invoicing and payments might include employers, corporations, outside organizations or State Prepaid Tuition Plans.

How do I make tuition and fee payments to Vanderbilt?

Vanderbilt offers several payment options.

When are tuition and fees due?

Payment deadlines are included on the E-bill. Please view the bill upon email notification.

What is the process for a refund, if I’m eligible?

The refund process is automated. Students are encouraged to sign up for Direct Deposit. This may be done through the student’s YES portal.

What is the Title IV Authorization?

By completing the Title IV Authorization, found in YES, Vanderbilt can apply your federal aid to all your charges, such as medical insurance, parking fines and other miscellaneous charges.

Who can I contact at Vanderbilt for billing and payment questions?

For billing and payment questions, contact Student accounts by email at student.accounts@vanderbilt.edu or by phone at 615-322-6693.

Financial Aid at Vanderbilt

Are scholarships offered for this program?

There is limited amount of Vanderbilt Peabody scholarships available for the online Peabody programs. Students may contact their admissions counselor for more information. The Vanderbilt Office of Financial Aid does not offer merit or need based scholarship or grants.

Is financial aid available for this program?

Yes, Federal Direct Unsubsidized Loans and the Direct Graduate PLUS Loans are available to eligible students.

How do I apply for Federal Direct loans?

Step 1: Complete the Free Application for Federal Student Aid (FAFSA).

Step 2: Complete Entrance Counseling.

Step 3: Submit the Loan Agreement Master Promissory Note (MPN) in order for your loans to disburse.

How will I receive my financial aid award letter?

Students who are admitted to the program and have completed the FAFSA will receive an award notification letter by mail. This may take up to five to seven business days from the time you are admitted if your FAFSA has been received.

Students who pay their enrollment deposit and set up their Vanderbilt VUNetID will view their financial aid offers and/or award revisions through YES. The Financial Aid link in YES contains your aid offer, cost of attendance (COA), financial aid checklist(s), and anticipated aid disbursement information.

Below are step-by-step instructions to view your Financial Aid Awards in the YES portal:

1. Once logged into the YES portal, students will see the below image and should click on “Financial Aid”.

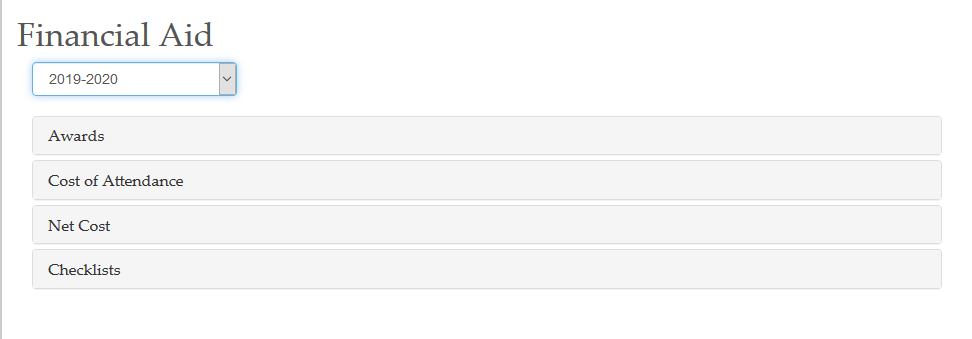

2. Next, the student should select the correct academic year to view.

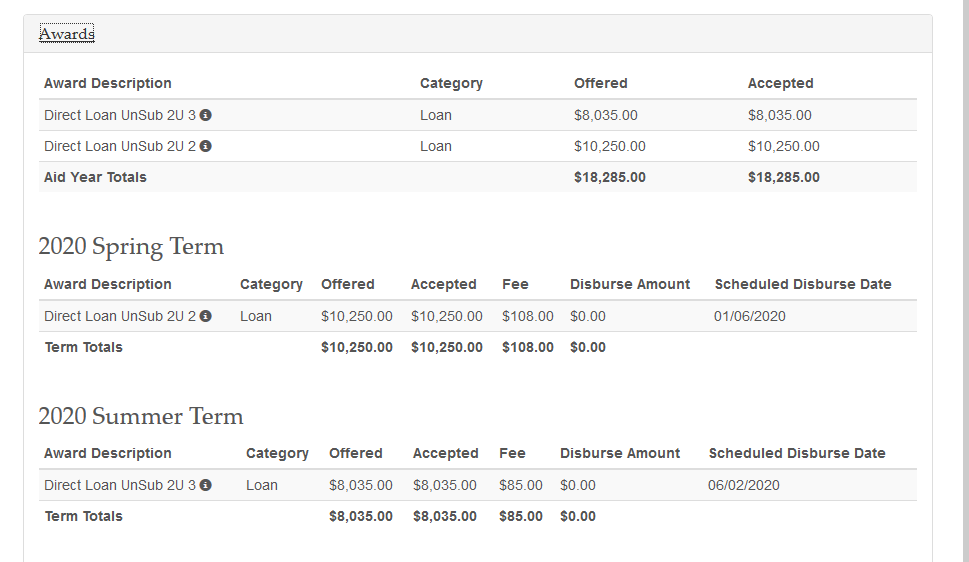

3. Then click “Awards”, which will provide a breakdown of the student’s financial aid package by the year and then by term.

When my financial aid award letter is added to YES, will I receive an email to my Vanderbilt email address notifying me?

Yes students will receive an award notification via email when their award is available to view in the YES student portal. This email is sent to their Vanderbilt email address.

When should I complete the FAFSA?

The FAFSA is available every October 1 for the upcoming academic year which begins with the August (fall) semester. New students planning to use federal student aid should complete a FAFSA while applying for admission. Continuing students will need to submit a FAFSA each year they plan to receive federal student aid. For additional information on which FAFSA to complete visit the VU Financial Aid Website for How to Apply.

Do I need to complete the FAFSA each year?

Yes. Because eligibility for federal student aid does not carry over from one award year to the next, you will need to complete the FAFSA for each award year for which you are or plan to be a student.

Will I be able to view my financial aid award package before submitting the deposit?

It depends on timing. Financial aid processing can take around five to seven business days after you have been admitted if you have a completed FAFSA. If you are admitted days prior to your start date, you may not have access to your award letter prior to deposit deadline.

Are there academic requirements I must meet to receive financial aid?

Students must maintain Satisfactory Academic Progress (SAP) to continue receiving financial aid.

How do I determine if I am enrolled full-time or half-time in the Vanderbilt online programs?

- Fall and Spring semesters: Students enrolled in at least 9 credits are considered full-time. Students enrolled in 6 credit hours are considered half-time.

- Summer semester: Students enrolled in at least 6 credits are considered full-time. Students enrolled in 3 credit hours are considered half-time.

What is the minimum number of credits required to receive federal student aid?

Students must be registered for a minimum of 6 credits for fall and spring terms and 3 credits for Summer in order to be eligible for federal student aid.

How do I accept my financial aid award?

Once the appropriate loan applications are completed the Office of Student Financial Aid will process the loan at the amount indicated on the award package. Students need to actively decline or request a reduction in loans by emailing loans@vanderbilt.edu.

Am I required to accept the full amount that I am offered on my award letter?

No, students are encouraged to borrow as little as possible. Students may email loans@vanderbilt.edu to reduce or decline their loans.

Does my Direct Loan eligibility cover the entire cost of the program?

Assuming the student is eligible for both the Direct Unsubsidized loan and the Direct Graduate PLUS loan, the student may borrow for tuition and fees in full for the current academic year.

How soon will loans disburse to my student account?

Loans are disbursed a week after classes start, after it has been verified the student has attended class.

Will students receive a loan disbursement each term?

Students may receive loans for each term they are enrolled at least half time.

Can I use loans to cover additional expenses (housing, books, supplies, etc.,)?

The total cost of attendance (COA) for the academic year includes tuition, fees and living expenses. If the student has eligibility for additional loan funds based on the COA, the student is able to use those resources to cover expenses such as books, supplies, and other miscellaneous expenses.

Who can I contact at Vanderbilt for financial aid questions?

For questions regarding financial aid at Vanderbilt, please contact finaid@vanderbilt.edu.

If I have sent an email, when should I expect to receive a response from the Financial Aid Office?

During peak times, students should allow at least three to four business days for a response. During normal time periods, allow at least two business days.

Additional Loan Information

Are private loans offered at Vanderbilt?

Lenders offer private alternative student loan programs with different rates, fees, repayment terms, and approval requirements. Vanderbilt provides a search tool, FASTChoice, which is a historical list of private lenders other VU students have used.

Is there a federal aggregate loan limit?

The aggregate loan limit for all federal loans, including undergraduate and graduate study, is $138,500. In addition to borrowing limitations based on the cost of attendance for the program, students are also limited in terms of lifetime borrowing.

If the total loan amount you receive over the course of your education reaches the aggregate loan limit, you are not eligible to receive additional loans. However, if you repay some of your loans to bring your outstanding loan debt below the aggregate loan limit, you could then borrow again, up to the amount of your remaining eligibility under the aggregate loan limit. You can learn more about graduate annual loan limits on the Federal Student Aid website.

How do I find out if I am near my aggregate loan limit or have defaulted on a federal student loan?

Log in on the StudentAid.gov homepage to view your federal student loan borrowing history and loan servicer details. Please note that private education loans are not listed on this site. Students in default are not eligible for additional federal loans. Contact your lender for default resolution options.

What is the difference between a Direct Unsubsidized Loan and a Direct Subsidized loan?

Direct Subsidized Loans are available to undergraduate students with financial need. The U.S. Department of Education pays the interest on subsidized loans while students are enrolled in their undergraduate program. The Direct Unsubsidized Loan is available to undergraduate and graduate students and does not require demonstration of financial need. The Unsubsidized Loan begins accruing interest as soon as funds are disbursed. Learn more about the difference between unsubsidized and subsidized loans.

What is the current Federal Direct Unsubsidized Loan interest rate?

The Federal Direct Unsubsidized Loan interest rate is determined on an annual basis. Learn more about interest rates on the Federal Student Aid website.

Are there any additional loan fees for the Federal Direct Unsubsidized Loan?

There is a loan origination fee that is a percentage of the total loan amount. The loan origination fee is deducted proportionately from each loan disbursement you receive. Information on Unsubsidized loan origination fees can be found on the Interest Rates and Fees page of the Federal Student Aid website.

What is the Direct Graduate PLUS Loan?

The Direct Graduate PLUS loan is a federal loan that graduate or professional degree students can use to help pay education expenses in addition to the Direct Unsubsidized Loan. Learn about Direct PLUS Loans.

Do Federal Direct PLUS Loans affect my aggregate loan limit?

Only Direct Subsidized/Unsubsidized Loans and prior Federal Family Education Loan (FFEL) Program count toward your aggregate loan limit.

What are the eligibility criteria to apply for the Federal Direct Graduate PLUS Loan?

A credit check will be conducted when applying for the Direct Graduate PLUS Loan. In addition to the federal student aid eligibility criteria, applicants cannot have an adverse credit history.

What are my options if I’m denied the Direct Graduate PLUS Loan?

If you are denied the Graduate PLUS loan, you may reapply with an endorser or follow instructions on the Department of Education’s website to appeal the denial.

How much can I borrow from the Direct Graduate PLUS Loan?

If approved for the Grad PLUS Loan, you can borrow up to the cost of attendance minus any other financial aid received. The cost of attendance includes tuition and fees, and allowances for indirect expenses like books, supplies, and living expenses.

What is the Graduate PLUS Loan current interest rate?

The Federal Direct Graduate PLUS Loan interest rate is determined at the beginning of each academic year, and is available on the Federal Student Aid website’s Interest Rates and Fees page.

Are there any additional loan fees for the Graduate PLUS Loan?

There is a loan origination fee that is a percentage of the total loan amount. The loan origination fee is deducted proportionately from each loan disbursement you receive. Information on Graduate PLUS Loan origination fees can be found on the Interest Rates and Fees page of the Federal Student Aid website.

Do I have to repay my student loans while I’m in school?

You are not required to pay your student loans while you are in school as long as you are enrolled at least half-time. Your unsubsidized loan will go into repayment six months after you graduate, fall below half-time status, take a leave of absence or withdraw from the program.

When do I have to repay my loan?

After you graduate, leave school or drop below half-time enrollment, you will have a six-month grace period before you are required to begin repayment. During this period, you’ll receive repayment information from your loan servicer, and you will be notified of your first payment due date. Payments are usually due monthly. You are not required to pay while in school, however if you choose to, there is no penalty to prepay. Learn more about repayment timelines.

What are the repayment plan options and how do I select one?

The Department of Education (DOE) offers multiple options for repayment. You may visit the DOE website for more information on loan repayment plans.

Is there a repayment calculator or estimator that I can use?

Yes, visit the DOE website for repayment calculators.

Can I consolidate my graduate loans and my undergraduate loans?

A Direct Consolidation Loan allows you to consolidate (combine) multiple federal education loans into one loan including both graduate and undergraduate loans. The result is a single monthly payment instead of multiple payments. Learn more about loan consolidation on the Federal Student Aid website.

Are there any loan forgiveness options available?

Please review the Department of Education website for more information on federal loan forgiveness programs.

VA Educational Benefits

How do I apply for VA educational benefits?

Prospective students should request a certificate of eligibility (COE) from the VA at 888-442-4551 or Apply for Benefits Online. If approved, the COE will list the remaining entitlement of the eligible individual and the ending date of the individual’s eligibility.

What is Vanderbilt’s tuition rate?

The cost of attendance (COA) is established each year by the Office of Student Financial Aid. For graduate and professional students at Peabody College, tuition is based on the number of credits for which you register each term. Tuition and fees are subject to increase each academic year. Current academic year rates are located on the tuition and fees page.

If I have more questions regarding VA benefits, who can I contact?

Questions regarding the certification of VA educational benefits should be directed to one of the VA School Certifying Officials in the Office of the University Registrar at VASCO@vanderbilt.edu. This will enable the first person who is available to respond.

Questions regarding remaining eligibility should be directed to the VA at 888-442-4551.

Tax Benefits for Education

How do I qualify for a tuition tax credit?

For detail on tax benefits for education, see IRS Publication 970, Tax Benefits for Higher Education, which provides detailed information. Vanderbilt University is unable to provide tax advice. We urge you to contact your tax advisor or the IRS at 800-829-1040 or irs.gov if you have any questions regarding the HOPE or Lifetime Learning Tax Credits.

What is the 1098-T Form?

It is an informational form filed with the Internal Revenue Service to report the amounts paid by you for qualified tuition, related expenses, and other related information. The primary purpose of the IRS Form 1098‐T is to inform you that we have provided this required information to the IRS.

What information is included in the 1098-T Form?

Form 1098-T reports amounts paid for qualified tuition, scholarship and grants processed during the calendar year to students enrolled in courses at Vanderbilt University for which they receive academic credit. The information reported on the 1098-T form helps students evaluate whether he or she is eligible for an educational tax credit.

How do I obtain my 1098-T Form?

Instructions for obtaining your 1098-T form can be found here.